Tax Information

It's that time of year again!

As you prepare your taxes, review this information.

Tax forms are mailed at the end of January, so please wait for them before you file your taxes. If you enrolled in eStatements and opted to receive your tax statements electronically, you can access them by logging into online banking, or the mobile app. Follow the instructions below:

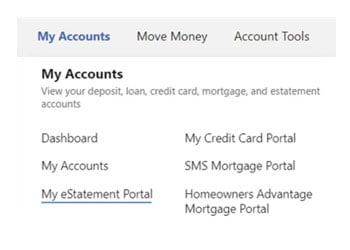

Desktop

1. Log in to your account at broadviewfcu.com

2. Select “My Accounts” then “eStatement Portal.”

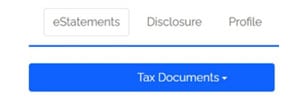

3. From the blue drop-down menu, choose “Tax Documents.”

4. Select your tax document to view, save, or print it.

Note: The PDF will open in a separate browser window.

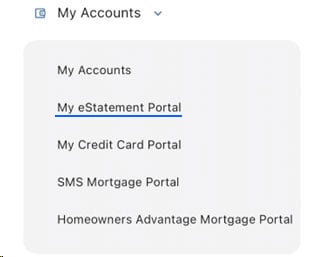

Mobile App

1) Launch your Broadview app and log in to your account

2) Select “More,” tap “My Accounts,” and “My eStatement Portal.”

3) Tap “Statements,” then “View Statements.”

4) From the blue drop-down menu, choose “Tax Documents.”

5. Select your tax document to view, save, or print it.

Reminder: When you file your federal and state tax returns, you will use the name “Broadview FCU” with the corresponding Taxpayer Identification Number (TIN) noted on your credit union tax document(s).

If you use an electronic tax filing service such as TurboTax, stored information from prior years may be inaccurate. Be sure to update your return with information from the tax form to avoid any complications.

Please note that you may receive multiple tax forms for last year if you had:

- More than one account at Broadview

- An account and/or mortgage at both Broadview and Homeowners Advantage

Frequently Asked Questions

When the total of all annual dividends across the credit union equals $10 or more, a 1099-INT is issued.

If you received a 1099-INT form, the dividends listed on the form(s) were reported to the IRS. According to the IRS, “You must report all taxable and tax-exempt interest on your federal income tax return, even if you don't receive a Form 1099-INT.” Please consult federal and state tax resources for further information.

If your accounts transitioned to Broadview, please update your direct deposit information when you file your taxes. If you forget, your refund will still be deposited. However, it’s best to provide your Broadview account information now before it’s required in the future. Broadview’s routing number is 221373383.

To locate your account number:

- Log in at broadviewfcu.com, select the account, then the Eye outline next to it OR

- In the Broadview mobile app, tap the account, then “Show Details” OR

- At the bottom of your checks, it’s the middle set of digits between the symbols

It’s always a good idea to verify your direct deposit information when you prepare your taxes.

You’ll find Broadview’s routing number – 221373383 – at broadviewfcu.com. Scroll down and you’ll see it at the bottom of every webpage.

To locate your account number:

- Log in at broadviewfcu.com, select the account, then the Eye outline next to it OR

- In the Broadview mobile app, tap the account, then “Show Details” OR

- At the bottom of your checks, it’s the middle set of digits between the symbols

No action is necessary if the address on your tax documents isn’t your current address. File your taxes as you normally would and update your address with us as soon as possible.

Do you have further questions about the tax document(s) you received or the information provided above? Please contact our team for assistance.