Take Charge of Your Credit Score

Manage Your Money

Learn how scoring works and ways to improve your score.

Your FICO credit score is a measurement of your credit risk. Your score can impact credit offers and interest rates you are eligible for. The percentages below reflect the FICO categories used to calculate your score.

- 35% Payment History

- 30% Amounts Owed

- 15% Length of Credit History

- 10% New Credit

- 10% Types of Credit Used

Here are a few simple ways that you can build better credit and raise your FICO score. Just keep in mind that repairing your score can require about 15 to 24 months of responsible budgeting.

Check Your Credit Report

A regular check of your credit report is a smart move because unauthorized activity can lower your score.

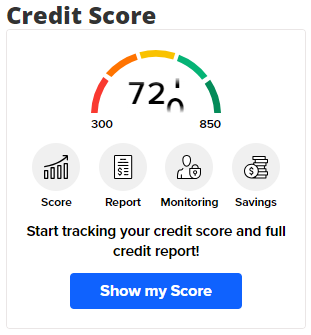

Free for Broadview members. Monitor your credit report and get your credit score in online banking and the mobile app. Choose the “Credit Score” feature to get started.

Credit Score also provides:

- Your credit worthiness rating

- Recommendations to improve your credit score

- Resources to help you improve your finances

- Personalized offers

Note: Utilizing this feature will not negatively impact your credit score.

Not a Broadview member yet? For full Credit Score benefits, open your account. You can also get a free credit report from the three major credit bureaus via www.annualcreditreport.com. For your FICO score, visit www.myfico.com.

Set Up Bill Pay Reminders

If there is one factor above all that can lift your score, it’s making your credit card and debt payments on time. Set up automatic payments through your credit card and lending institutions. Then, monitor your budget over time.

Use Your Credit Card Responsibly

A good rule of thumb is to keep your credit card balance at or below 30 percent of your credit limit. So, if you’ve got a $1,000 limit, you should use $300 as a personal benchmark.