10 Things You Can Do To Improve Your Credit Score

Manage Your Money

Raise your score over time by demonstrating that you consistently manage your credit responsibly.

When you apply for credit, your credit scores help lenders determine whether or not you are able to repay the loan based on your past financial performance. With a higher score, you qualify for better interest rates, higher credit limits and more types of credit than you would with a lower score.

Your score reflects the way you use credit – there are no quick fixes that allow you to get a good score. However, you can raise your score over time by demonstrating that you consistently manage your credit responsibly.

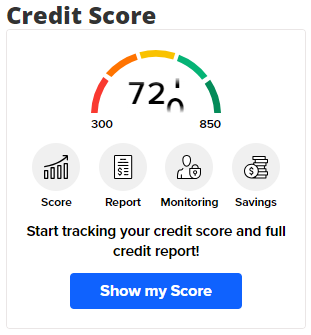

Free credit score for Broadview members! In online banking and the mobile app, choose the “Credit Score” feature to get started. Tell me more.

10 things you can do

1. Pay your bills on time.

If you have a history of paying your bills on time, you’ll have an easier time getting a mortgage loan, car loan, or credit cards. Even if you’ve had serious delinquencies in the past, a recent history (24 months) of on-time payments carries weight in credit decisions.

2. Keep your credit card balances low.

High outstanding debt can pull your score down.

3. Check your credit report for accuracy.

A regular check of your credit report is a smart move because unauthorized activity can lower your score. If you see an error, contact the original creditor and the major credit bureaus to clear it up.

4. Pay down debt.

Consolidating your credit card debt or spreading it over multiple cards will not improve your score in the long run. The most effective way to improve your credit is by slowly paying down the amount you owe.

5. Use credit cards – but manage them responsibly.

In general, having credit cards and installment loans that you pay on time will raise your score. Someone who has no credit cards tends to have a lower score than someone who has already proven that he can manage credit cards responsibly.

6. Don’t open multiple accounts too quickly, especially if you have a short credit history.

This can look risky because you are taking on a lot of possible debt. New accounts will also lower the average age of your existing accounts which is something that your credit score also considers.

7. Don’t close an account to remove it from your record.

If you have inaccurate information on your credit report, it can be cleared up easily. Always contact the original creditor and the credit bureaus to clear up an error so that the inaccurate information won’t reappear later.

8. Shop for a loan within a focused period of time.

Credit scores distinguish between a search for a single loan and a search for many new credit lines (based in part on the length of time during which recent requests for credit occur).

9. Don’t open new credit card accounts you don’t need.

This approach could backfire and actually lower your score.

10. Contact your creditors or see a legitimate credit counselor if you’re having financial difficulties.

This won’t improve your score immediately, but the sooner you begin managing your credit well and making timely payments, the sooner your score will get better.

These ideas won’t dramatically improve your credit score overnight, but they will over time. Remember, it takes time to develop a strong profile, but once you’ve done it, you’ll find it a lot easier to apply for credit and get favorable interest rates.

Get your credit score and monitor your credit report with the “Credit Score” feature in Broadview’s online banking and the mobile app.

Credit Score also provides:

- Your credit worthiness rating

- Recommendations to improve your credit score

- Resources to help you improve your finances

- Personalized offers

Note: Utilizing this feature will not negatively impact your credit score.

Not a Broadview member yet? For full Credit Score benefits, open your account. You can also get a free credit report from the three major credit bureaus via www.annualcreditreport.com. For your FICO score, visit www.myfico.com.