Get started

See guidance

Understand the basics of your Broadview accounts and services.

Do you have a business account or a specialty account (trust, estate, rep payee, etc.)? See information for you.

Account basics

Your accounts have moved to Broadview and nearly all services are the same.

You have one new member number plus a new 10-digit number for each account. Having all your accounts under one member number allows you to see them in one view online. Get started with digital banking and find your new member number.

If you’re already a Broadview member, you keep that member number. Your CAP COM accounts were folded into your Broadview relationship and assigned new account numbers.

Names of a few account types have changed for simplicity’s sake. For instance, Consumer’s Choice Checking is Free Checking and Owner’s Choice Savings is Choice Savings.

New direct deposits you add require your new account number and Broadview’s routing number 221373383. The routing number can always be found at the bottom of broadviewfcu.com.

If you have overdraft protection, it is shifting to parallel Broadview services. You can learn more at broadviewfcu.com/overdraft.

If you have a business or specialty account (trust, estate, rep payee), here’s additional information for you.

Explore other Get started topics. Questions? Contact us. Return to the Member Resource Center homepage.

Statements

CAP COM members will begin receiving new Broadview statements in July.

Broadview account statements will arrive on the same schedule as before, by mail or online (however you received them previously).

If you want to receive eStatements instead of paper statements in the mail, it’s easy to enroll in online banking. Once you log in, click the “My Accounts” tab, then “My eStatements Portal.”

How are Broadview account statements different?

- Only primary account holders will receive a statement or have access to an eStatement.

- If you’re a joint owner on an account, you won’t receive a separate statement for that account. To view all Broadview account activity, log in to your account in your digital banking.

- Broadview statements will display your member number at the top.

A new benefit is that you can consolidate your Broadview statements to see all transactions at a glance and reduce paper. Contact us to learn more about combining statements.

Digital banking

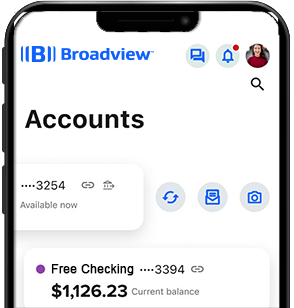

Once you log in, you’ll see ALL your accounts – including primary and joint accounts you share –on your Dashboard.

To log in the first time, see digital banking in 5 steps. In brief:

- Log in with the current username and password for your oldest account

Tip: If you have multiple accounts, the oldest typically has the smallest number. - Enter the Social Security Number associated with your account.

- Receive the access code and create your new password

You can hide accounts you don’t want to see. Click the gear icon for your dashboard settings. Uncheck accounts to hide them and click “Save.” Hiding will not delete them.

Your member number can be found under settings:

- Desktop: Click the Profile icon

, then go to Settings

, then go to Settings - Mobile: Click the Profile icon

, navigate to Settings, then Profile

, navigate to Settings, then Profile

For your account numbers, select the account from your Dashboard to see it. ![]()

If you have more than one username, each has carried over to Broadview digital banking. If the username is unavailable, you must set a new one. See how in the FAQs.

New digital banking features enable you to:

- Access live chat from your account dashboard

- Create and track savings goals

- See visualizations of balances and spending

- Customize your dashboard image (browser only)

- Obtain your free credit score (optional), refreshed daily

If you use these account features, they will need your attention.

- Any debit card controls you have must be reset.

Log in for: "Card Management" options under "Account Tools" - If you used account alerts, they must be reset.

Log in to create: "Alerts" under "Account Tools" - Text banking has a new number. You can reenroll through online banking

Your Bill Pay information carried over. You’ll see:

- Companies and people you pay

- Account numbers, amounts, and payment dates

- Upcoming scheduled payments

- 12 months of payment history

If you use these Bill Pay features, they'll need your attention.

- Reminders will need to be reset. To create them:

- Log in and under "Move Money," select "Pay a Bill."

- In your Payment Center, select the "Reminders" link

- To receive e-bills, you’ll need to enroll

If you use QuickBooks or Quicken software, they need your attention.

You’ll need to make changes in the settings of your QuickBooks or Quicken software. See instructions below.

Explore other Get started topics. Questions? Contact us. Return to the Member Resource Center homepage.

Staying the same

Nearly all the same products are offered, along with some added benefits. Read on for a roundup of what will stay the same.

You can keep using your debit cards, credit cards, and checks. If you have a favorite branch, staffing and services are the same.

Read on for a roundup of what's the same at Broadview.

What's staying the same?

| Keep banking as usual |

Explore other Get started topics. Questions? Contact us. Return to the Member Resource Center homepage.

Nickname your accounts

|

When you log in, you'll see ALL of your accounts on one dashboard, including joint accounts you share. Nicknames make it easy to tell them apart. Spend just a minute and you'll be glad you did! |

| 1. Log in to your online account(s) at broadviewfcu.com. Or in the Broadview app, select Settings, then Accounts. |

| 2. On your dashboard, click an account |

| 3. On the next screen, select the pencil icon |

| 4. In the pop-up window, rename your account |

| 5. Hide it if you want, then click "Save." |

If you don’t use online banking, we can set up your nicknames for you. For help, please contact us.

Explore other Get started topics. Questions? Contact us. Return to the Member Resource Center homepage.

Added benefits

Providing lifelong financial services that help you prosper is why we're here.

There are some new benefits you will be able to access right away. The more resources you use, the more you can gain!

And more will be coming as we continue building Broadview for you!

Here are some added benefits

| You might like |

Explore other Get started topics. Questions? Contact us. Return to the Member Resource Center homepage.